CMPort Achieves Strong Operational Performance in the First Half of 2024 with Robust Growth in Overseas Business

On August 30, the Board of Directors of China Merchants Port Holdings Co., Ltd. ("CMPort" or "the Company," Hong Kong Stock Exchange stock code 00144) is pleased to announce the interim results of the Company and its subsidiaries ("the Group") for the period ended June 30, 2024.

2024 Interim Performance Overview:

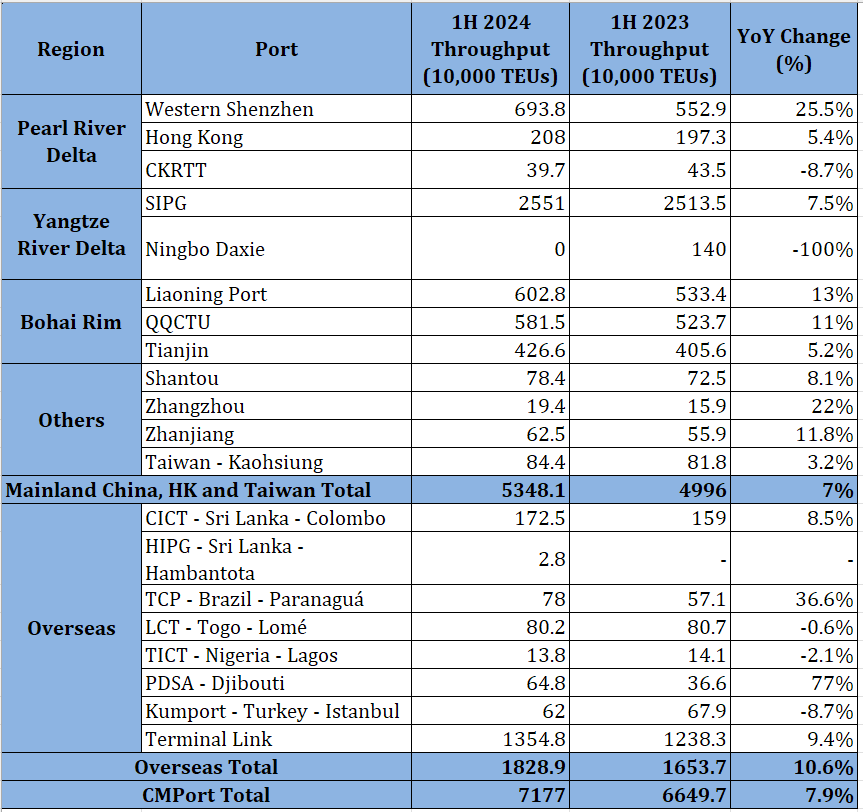

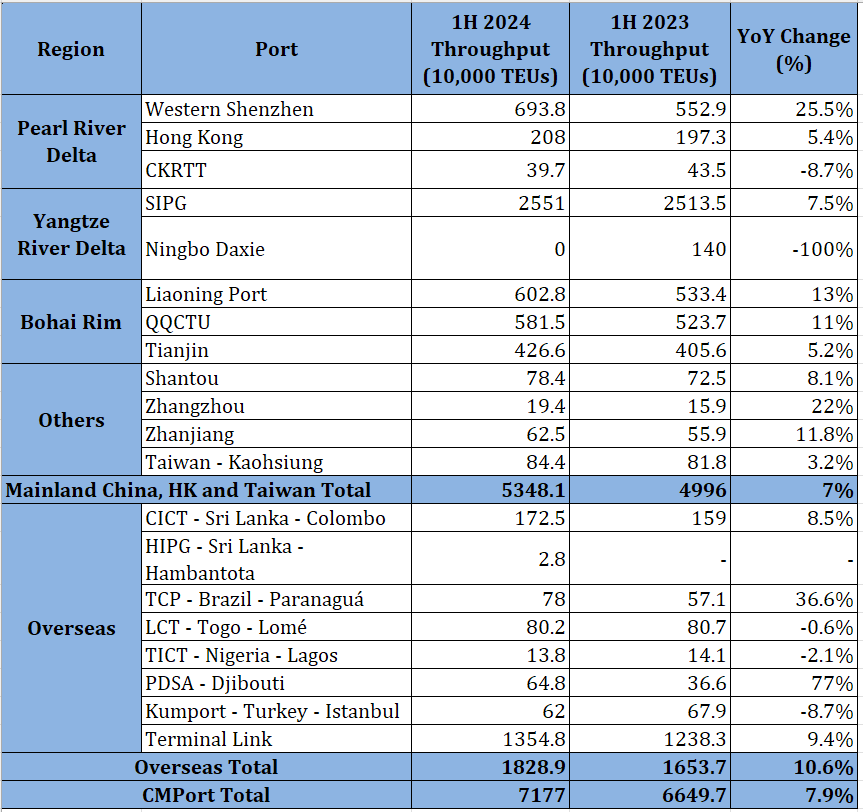

Throughput of containers handled reached 71.77 million TEUs (1H 2023: 66.50 million TEUs), up 7.9% YoY

Throughput of bulk cargo handled reached 274 million tons (1H 2023: 270 million tons), up 1.7% YoY

Revenue of HK$5.795 billion (1H 2023: HK$5.805 billion), down 0.2% YoY

Net Profit attributable to equity holders of the Company amounted to HK$4.452 billion (1H 2023: HK$3.351 billion), up 32.9% YoY

Recurrent profit attributable to equity holders of the Company was HK$4.154 billion (1H 2023: HK$3.325 billion), up 24.9% YoY

Interim dividend of 25 HK cents per ordinary share (1H 2023: 22 HK cents per share)

In the first half of 2024, the Group achieved solid operational performance and steady business growth. Container throughput reached 71.77 million TEUs, representing a year-on-year increase of 7.9%, with 53.48 million TEUs handled in the Greater China region and 18.29 million TEUs in overseas regions. The Group's bulk cargo throughput totaled 274 million tons, up 1.7% year-on-year. Revenue for the period was HKD 5.795 billion, while net profit attributable to equity holders of the Company was HKD 4.452 billion. Recurrent profit attributable to equity holders of the Company was HKD 4.154 billion.

To reward shareholders for their continued support, the Board of Directors proposes a 2024 interim dividend of 25 HK cents per ordinary share, to be paid in Hong Kong dollars in cash.

ATTACHED TABLE: 1H 2024 CMPORT CONTAINER THROUGHPUT OVERVIEW

Homebase Port Development: Maintaining Regional Advantages and Extending the Industrial Chain

The Western Shenzhen Homebase Port's container throughput growth year-on-year exceeded that of Shenzhen Port overall. Its bulk cargo business also maintained its strong position across multiple cargo types. The Sri Lanka homebase port continued its efforts to establish itself as the international shipping center for the South Asia region. CICT consistently optimized its route structure, focusing on expanding the local cargo owner market, solidifying its foundation, and increasing its market share in the local container segment. It also extended the industrial chain, building a logistics ecosystem and aiming to develop the South Asia Commercial and Logistics Hub into a new growth driver. HIPG accelerated its transformation and upgrade, continuously enhancing its core competitiveness by launching container operations, solidifying RoRo business, exploring value-added RoRo services, advancing the Sinopec refining project, and strengthening infrastructure development, leading to diversified and rapid business growth.

Operational Management: Strengthening Business Coordination and Deepening Lean Management

In market and business management, the Group has enhanced service quality, strengthened business coordination, and unified its market and business management systems. It established market information sharing and joint marketing initiatives, focusing on the changes in global shipping alliance routes to develop agile business combination strategies. In terms of lean management, the Group leveraged the Smart Management Platform (SMP) to create a one-stop integrated management platform, supporting business analysis across all sectors, including container, bulk cargo, logistics parks, comprehensive development, and smart technology. The application of smart tools is driving the transformation of the Group's operational management methods, models, and concepts. Additionally, the Group continued to implement the COE lean operations mechanism, which supports strategy, business operations, and value creation by addressing business pain points and challenges, optimizing the “Lean Operation Value Tree” Model, and further improving the management system to fuel the achievement of strategic goals.

Technological Innovation: Building Green Ports and Promoting Digital Products

The Group has achieved new breakthroughs in building green ports and promoting digital products. In the first half of 2024, CICT completed the electrification of 54 trucks, and 175 new electric trucks were added at the Western Shenzhen Port Zone, along with the orderly implementation of new green projects, such as the installation of additional photovoltaic systems. The Group's joint venture, CMIT, signed a CTOS cooperation agreement with Italy's Mediterranean Intermodal Terminal Operator, marking the second project in Europe following the Thessaloniki Container Terminal in Greece. The Group continues to strengthen technological innovation and service upgrades, exploring the development of digital ports with international partners to provide smarter and more efficient solutions for global customers.

Overseas Expansion: Key Project Implementation and New Breakthroughs in Global Layout

On June 28, 2024, the Group completed the acquisition of a 51% equity stake in NPH. NPH is a company listed on the Indonesia Stock Exchange, primarily engaged in container, multipurpose, and general terminal services, as well as providing port equipment engineering services. It operates two container terminals at Jakarta, Indonesia's largest container port. This acquisition marks a groundbreaking achievement for the Group, as it gains control of container terminals in Southeast Asia for the first time. Moving forward, the Group plans to use NPH as a platform to further develop Indonesia's port and logistics market. Additionally, following the "Port + Logistics" model, the South Asia Commercial and Logistics Hub project is progressing as planned. This project will significantly enhance local logistics services and attract more business and throughput to Colombo Port, further solidifying its status as a key hub in the South Asia region.

Deepening Reform: Advancing Continuous Reform to Drive Leapfrog Development

The Group remains focused on "enhancing core competitiveness and strengthening core functions" as it continues to deepen reform. Key aspects of reform and innovation have been integrated into the operational indicators of its subsidiaries. In terms of talent selection, the Group has established a tiered and categorized, efficient, and transparent public recruitment mechanism to ensure a fair, just, and open selection process. The Group also continues to cultivate cross-cultural talent, injecting fresh energy and vitality into its development. The Group is continuously improving its ESG management system, optimizing management practices and work processes, and integrating ESG principles into daily port operations. Additionally, the Group actively engages with ESG rating agencies to further enhance the breadth and depth of its ESG disclosures. The Group's ESG performance has been recognized by leading institutions and investors, maintaining a BB rating in the MSCI ESG assessment, consistent with last year's rating.

Implementing New Development Concepts and Steadily Advancing Towards High-Quality Growth

In the second half of 2024, the Group will aim for high-quality development by fully and accurately implementing new development concepts. Through its six major strategies, the Group will accelerate technology leadership and innovation-driven growth, achieve global expansion and balanced development, and provide top-tier comprehensive port service solutions. With a focus on executing all development initiatives, the Group is steadily progressing towards becoming a "world-leading comprehensive port service provider with high quality."