Striving for High-Quality Development

CMPort recorded Growth in both Revenue and Recurrent Profit in 2022

On March 31, the board of directors of China Merchants Port Holdings Co., Ltd. ("CMPort" or "the Company", Hong Kong Stock Exchange stock code 00144) is pleased to announce the annual results of the Company and its subsidiaries for the year ended December 31, 2022.

2022 Annual Performance Overview:

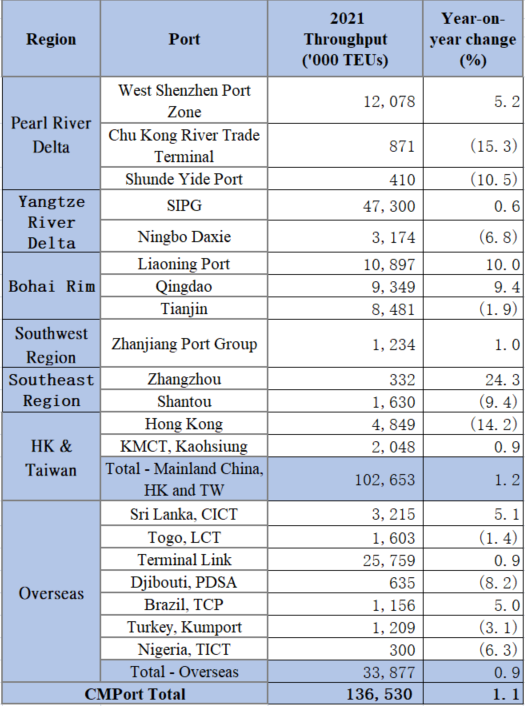

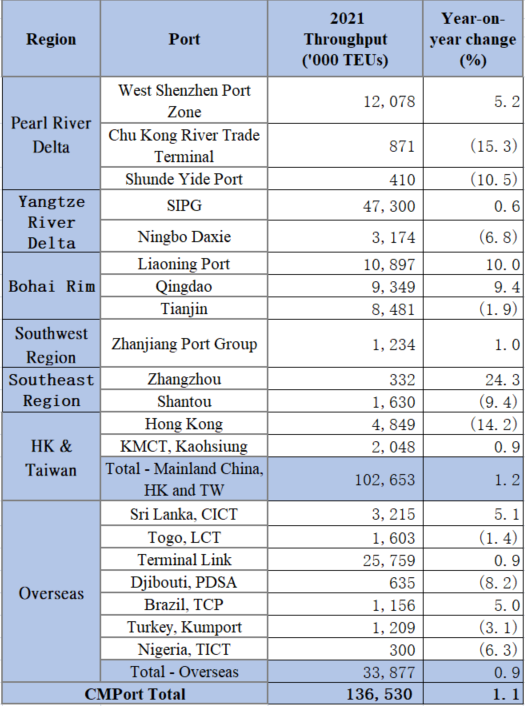

Throughput of containers handled reached 136.53 million TEUs, up 1.1% (2021: 135.04 million TEUs)

Throughput of bulk cargoes handled reached 547 million tons, down 3.6% (2021: 567 million tons)

Revenue of HK$12,545 million (2021: HK$11,850 million), a year-on-year increase of 5.9%

Recurrent profit attributable to equity holders of the Company Note [1] was HK$8,121 million (2021: HK$7,537 million), up 7.7% year-on-year

Net Profit attributable to equity holders of the Company amounted to HK$7,781 million (2021: HK$8,144 million), a year-on-year decrease of 4.5%

Annual dividend of 82 HK cents per ordinary share, payout ratio 42%

Note 1: Profits attributable to equity holders of the Company net of non-recurrent losses/gains after tax. Non-recurrent losses/gains include: for 2022, net change in fair value of financial assets at fair value through profit or loss, net change in fair value of investment properties and net loss on deemed disposal of partial interest in an associate; while for 2021, net change in fair value of financial assets and liabilities at fair value through profit or loss, net change in fair value of investment properties, gain on modification of contract terms for a concession arrangement, gain on deemed disposal of a subsidiary and net gain on deemed disposal of partial interest in associates.

In 2022, CMPort strived to achieve the strategic goal of becoming a “world’s leading comprehensive port service provider with high quality”, proactively coped with challenges, and successfully completed all operational objectives. The Company's ports handled a total container throughput of 136.53 million TEUs, up 1.1% year-on-year, of which the overseas throughput increased by 0.9% year-on-year; it handled a bulk cargo throughput of 547 million tons. The Company recorded a total revenue of HK$12.545 billion, a year-on-year increase of 5.9%. The recurrent profit attributable to equity holders of the Company was HK$8.121 billion, increased by 7.7% year-on-year. Due to the net income obtained from the dilution of equity after the integration of Liaoning Port Co., Ltd. in 2021, the net profit attributable to the company's equity holders decreased by 4.5% to HK$7.781 billion.

In order to reward the shareholders for their consistent support, the board of directors of the company proposes to distribute a final dividend of 60 Hong Kong cents per ordinary share; together with the interim dividend of 22 Hong Kong cents per ordinary share, the 2022 annual dividend per ordinary share is 82 Hong Kong cents, representing a 42% annual payout ratio. The Company attaches great importance to shareholder returns and is committed to providing shareholders with stable and sustainable returns. The company's target dividend payout ratio for the coming year is no less than 40%, which will be realized upon approval by shareholders at the general meeting.

Note 1: Profits attributable to equity holders of the Company net of non-recurrent losses/gains after tax. Non-recurrent losses/gains include: for 2022, net change in fair value of financial assets at fair value through profit or loss, net change in fair value of investment properties and net loss on deemed disposal of partial interest in an associate; while for 2021, net change in fair value of financial assets and liabilities at fair value through profit or loss, net change in fair value of investment properties, gain on modification of contract terms for a concession arrangement, gain on deemed disposal of a subsidiary and net gain on deemed disposal of partial interest in associates.

Attached table: 2022 CMPort Container Throughput Overview

Steady Growth for Container Business Continues: West Shenzhen & Overseas Homebase ports Hit Record High Volumes against Headwinds amid Fluctuating Economic Environment

In 2022, terminals under the Company’s subsidiaries were able to raise tariffs under favorable conditions during the first half of the year and maintained volumes against the trend during the second half of the year, making steady progress by and large. The container throughput of the West Shenzhen Homebase Port increased by 5.2%, outperforming the Shenzhen port zone average; Mawan Smart Port has operated efficiently since its opening, completing 3.29 million TEUs, a year-on-year increase of 26%, fully demonstrating the characteristics of system intelligence, equipment automation and management standardization for modern ports. The “coordinated ports” model in the Guangdong-Hong Kong-Macao Greater Bay Area continues to expand. A total of 25 coordinated ports have been opened, serving more than 4,700 import and export enterprises in the Greater Bay Area, with a cumulative throughput of 260,000 TEUs, further strengthening the West Shenzhen Homebase port as the core of a multidimensional business synergy alliance.

In terms of the overseas homebase ports, the container throughput of CICT in Sri Lanka hit a new high, up 5.1% year-on-year, and its market share continued to lead the entire port of Colombo; Meanwhile, volumes for ro-ro ships at HIPG increased by 4.2% year-on-year. The company is striving to build CICT into an international container hub port and HIPG into a key regional comprehensive port, as it continues to promote the construction of an international shipping center in South Asia.

Accelerating Industrial Digitalization and Achieve Results in Innovation and Development

The company is actively accelerating industrial digitalization and continues to promote the construction of three innovative platforms: "CMCore", "CMePort" and "SMP". At the same time, it is deepening the construction of Mawan Smart Port to help reduce operating costs and increase efficiency. Its key technology for the digitalization and intelligent transformation of container terminals was recognized as a Major 2022 Scientific & Technological Innovation Achievement by the Ministry of Transport of China. It also held the “Digital & Intelligent Transformation in Ports & Shipping Forum” to focus on new development trends and explore space for industrial chain cooperation, which was viewed and liked by more than 100,000 people online.

Coordinating, Developing and Optimize Capital Operation to Continuously Improve Asset Profitability

The company continued to promote the dual-wheel drive model of “asset operation + capital operation”. During the year, the Group completed the acquisition of AAT to 34.6%, which helped create synergies among the Group’s terminal operation, bonded warehousing, and airport businesses of Hong Kong; it also facilitated the development of the logistics and supply chain in the Greater Bay Area. Following the acquisition of the equity interests in SIPG, the Group’s shareholding percentage in SIPG went up to 28.05%, which allowed the Group to boost asset profitability.

Safeguarding the National Sea Gate through Scientific Pandemic Prevention and Actively Aiding Hong Kong

The company insisted on both COVID prevention & control and production & operation, scientifically and accurately responded to the epidemic in the West Shenzhen Port Zone, withstood multiple rounds of COVID waves, and achieved record operational results. Regarding assistance to Hong Kong, the West Shenzhen Port Zone launched a special shipping route to Hong Kong, which guaranteed an efficient channel for goods supply in support of the fight against the pandemic. In 2022, the special shipping route to Hong Kong reached 4,051 voyages and served export laden containers of 0.20 million TEUs without waiting for berth and without backlog at container yard. The West Shenzhen Port Zone has become the port with the shortest distance and time of transport, the highest frequency of shipping and the largest transportation capacity from Shenzhen to Hong Kong.

Induction of Business and Investment for Overseas Logistics Parks Progressing steadily, Bonded Logistics business Remaining Stable

By the end of the year, there were 40 contracted enterprises in the HIPG Industrial Park and 287 contracted enterprises in the Djibouti International Free Trade Zone. The Djibouti Project established a new sea-air transportation and logistics channel between China and major African cities by collaboration with its strategic partners, which would shorten transit time and lower transportation costs and further enhance the service capability of the international logistics supply chain.

In terms of the bonded logistics business, the average warehouse utilization rate of China Merchants Bonded in Shenzhen is 98%, that of Qingdao Bonded is 100%, that of Tianjin Haitian Bonded is 90%, and that of wholly owned and associated bonded warehouses in the Djibouti International Free Trade Zone is 95% and 100%, respectively.

Facilitating Sustainable Development of both the Enterprise and Society

By combining corporate social responsibility with daily operations and business practices, the company promotes the path of sustainable development between the enterprise and the society. First, the company has strengthened energy-saving and emission-reduction management in construction, production, and operation, and continued to expand the application of new energy-saving technologies and products such as shore-powered supply for vessels, revolve container machines and clean energy. Second, it takes measures to reduce the impact of its operations on neighboring communities and the marine ecosystem. For instance, HIPG continues to promote the "Human-Elephant Peace" and "SaveALIPANCHA" elephant conservation projects. Third, the company continues to carry out the " China Merchant Silk Road Hope Village" program to create local job, improve the living environment, raise the living standards of residents, and create a happy and harmonious new village. Fourth, it strictly abides by local laws, regulations, and standards related to health and safety and fully fulfills its main responsibility for occupational health and production safety.

Promoting Comprehensive and High-quality Development and Providing First-class, Professional Comprehensive Port Service Solutions

Looking forward to 2023, CMPort will adhere to the general tone of "seeking progress while maintaining stability” and use the dual-wheel drive model of "endogenous growth" and "innovation & upgrade" to focus on improving homebase port expansion, innovation, operation optimization, layout expansion, business projection, risk prevention, and other capabilities. By excelling in digitalization, marketization, internationalization, platformization and intelligentization, it will continue to promote comprehensive and high-quality development and embark on a new journey, to achieve the strategic goal of becoming “a global leading comprehensive port service provider with high quality” and bring greater returns to shareholders while creating higher value for stakeholders.