CMPort strives for “World-Class” standard with sound 2021 interim performances

The Board of Directors (the “Board”) of China Merchants Port Holdings Company Limited (“CMPort” or the “Company”, HKSE Code: 00144) is pleased to announce the interim results of the Company and its subsidiaries (the “Group”) for the period ended 30 June 2021.

An online press conference was held on 30 August 2021 in Shenzhen and was hosted by the Chairman of the Board of CMPort, Mr. Deng Renjie. Mr. Wang Xiufeng, the newly appointed Managing Director, first introduced the 2021 interim results of CMPort. After that, Mr. Deng Renjie and Mr. Wang Xiufeng answered questions from the press together with Deputy General Manager Mr. Lu Yongxin, Deputy General Manager Mr. Li Yubin, General Manager of Finance Department, Mr. Sun Ligan.

Amid the normalization of Covid-19 pandemic, port congestions has become often, the press are concerned about the measures taken by CMPort. Mr. Deng Renjie said, “The Covid-19 pandemic has indeed brought challenges to the operation efficiency of the terminals, the major ports of CMPort have actively optimized the operation process to minimize the operation time of ships. At the same time, CMPort has actively communicated with shipping companies and cargo owners while implementing the heavy container reservation system to reduce the residence time of heavy containers in the yard. In result, CMPort was able to strengthen the overall coordination of production and operation, and secured the efficiency and smoothness of the supply chain system. Overall speaking, the operation of major ports at home and abroad of CMPort are generally stable.”

Mr. Wang Xiufeng responded to the question concerning the future development plan of the Company, he emphasised, “On the one hand, CMPort should always focus on customers and continuously innovate its business service model by focusing on solving customer difficulties, logistics breakpoints and block points of trade. CMPort should utilize the core value of port industry in the international logistics supply chain and continue to create profit growth value for ports. On the other hand, CMPort should accelerate compliance with the digital and intelligent development trend in the field of port and shipping logistics, promoting the deep integration of new technologies such as big data, Internet, artificial intelligence and block chain, and the construction of smart port ecosystem. I hope that the Company will realize the strategic goal of being ‘a world-class comprehensive port service provider’ as soon as possible.”

With respect to the future investment plans, Lu Yongxin said, “The pandemic has interfered our overseas business activities. CMPort has taken varies methods such as following up investment opportunities in Southeast Asia and South Asia through our homebase port team in Sri Lanka, we are also actively looking for business opportunities in Europe and America through our joint venture platform, namely Terminal Link. We believe that there will be substantial progress in the second half of the year. With regard to the acquisition of the two terminals in Vietnam and India that have not been completed so far, the Company is still maintaining close communication with CMA CGM. In case the acquisition could not be completed eventually, the equity acquisition agreement (SPA) signed by both parties had relevant guarantee mechanisms to protect the the rights and interests of the Company.”

CMPort first launched GBA Coordinated Port project in November 2020 and has achieved remarkable results. Li Yubin said, “GBA Coordinated Port project is a custom clearance facilitation platform built based on block chain technology covering the GBA with CMPort West Shenzhen homebase port. Six projects has been launched so far and will be promoted to more inland river terminals along the Pearl River by the end of the year, aiming to bring more convenient customs clearance services to customers. In the next step, more value-added services will be provided, with the aim to provide varieties of efficient services through connecting our customers in Pearl River delta with hub ports.”

CMPort’s profit has been tripled during the first half of 2021 and the media was concerned with the Company’s cash flow. Mr. Sun Ligan responded, “Both the total liabilities and financial costs of the Group decreased due to repayment of bank loans. According to the full-year plan, ports operation will continuously generate stable cash inflow. Meanwhile the Company has sufficient bank deposits and leverages to deal with future payment demands, the Company also has increased its ability on risk management.”

In response to the question on how Hong Kong would be able to seize opportunities under the 14th Five-Year Plan, Mr. Wang Xiufeng said, “The 14th Five-Year Plan will create unlimited opportunities for Hong Kong. Being the important channel to foreign investment and overseas financing, Hong Kong has built critical bridges between Mainland China and the world. As the first red chip enterprise listed in Hong Kong stock market, CMPort has been benefitted from the convenience in international trade and the advantages in international capital markets of this cosmopolitan, developing towards “World-Class” standard. We are willing to respond to the 14th Five-Year Plan and assist Hong Kong to embrace opportunities in order to refresh the ‘Pearl of the East’.”

Looking forward into the second half of 2021, Mr. Deng Renjie emphasized, “The pandemic prevention and control work is our top priority. The Company will continue to strictly ensure compliance with the prevention process and guidelines, securing the operation while doing well in the prevention work. In addition, the global economy will tend to faster recovery, which will provide positive impact on global trade. Ports operation had been back to normal in the second half of 2020, yet there are still a lot of uncertainties alongside the trade frictions and repeated outbreaks. We expect a mid to high single-digit growth on the container throughput for the whole year, as well as a better profit compared with the corresponding period last year.”

Highlights of 2021 interim results of the Group:

l Container throughput volume rose by 21.2% year-on-year to 66.51 million TEUs (1H2020: 54.87 million TEUs) l Total bulk cargo volume handled 284 million tonnes (1H2020: 199 million tonnes),rose by 42.8% year-on-year l Profit attributable to equity holders of the Company amounted to HK$4,711million (1H2020: HK$1,546 million), rose by 204.7% year-on-year Ø Profit attributable to equity holders of the Company derived from ports operation amounted to HK$4,626 million (1H2020: HK$2,265 million), rose by 104.2% year-on-year l Recurrent profitNote 1amounted to HK$4,530 million (1H2020: HK$1,409 million), rose by 221.5% year-on-year Ø Recurrent profit derived from ports operation amounted to HK$4,448 million (1H2020:HK$2,214 million), rose by 100.9% year-on-year l Basic earnings per share was 128.67 HK cents (1H2020: 44.83 HK cents), up by 187.0% year-on-year l Interim dividend of 【】HK cents per ordinary share (1H2020:18 HK cents per ordinary share) |

In the first half of 2021, with the continuous advancement of COVID-19 vaccination, the pandemic situation has eased. Despite the recurring pandemic situations in some European countries, United States and developing countries, the global economy has been out of the doldrums and continued to recover amidst fluctuations which was benefitted from the fiscal and monetary stimulus policies generally adopted by various countries and the resumption of industrial production and consumption activities. As the global trade steadily recovered, the overall performance of the port industry was in good business condition, and throughput volume and berth utilization continued to move up. CMPort continue to adhere to the general tone of making progress while remaining stable, embarking on a new development stage, being committed to a new development philosophy, building a new pattern of development and fully promoting high-quality development, the Group has achieved outstanding operating results. During the first half of 2021, the Group’s ports handled a total container throughput of 66.51 million TEUs, up by 21.2% as compared with the corresponding period last year, and bulk cargo volume of 284 million tonnes, up by 42.8% over the same period of the previous year.

For the six months ended 30 June 2021, the Group recorded a revenue of HK$5,663 million, up by 38.9% year-on-year, which was mainly due to the high business volume of ports operation. Profits attributable to equity holders of the Company amounted to HK$4,711 million, representing an increase of 204.7% year-on-year, which included a gain of HK$450 million (net of tax) on deemed disposal of partial interest of Liaoning Port Co., Ltd. (“Liaoning Port”) during the period by participating in its integration, while the amount for the same period last year included a net gain of HK$277 million (net of tax) on resumption of certain land parcels at Shantou. The recurrent profit increased by 221.5% year-on-year to HK$4,530 million, which was due to the increase in revenue and increase in share of profits of associates.

To appreciate shareholders for their continuous support, the Board of the Company proposed a 2021 interim dividend of 22HK cents per ordinary share. Shareholders may elect to receive the interim dividend in cash or by way of scrip dividend.

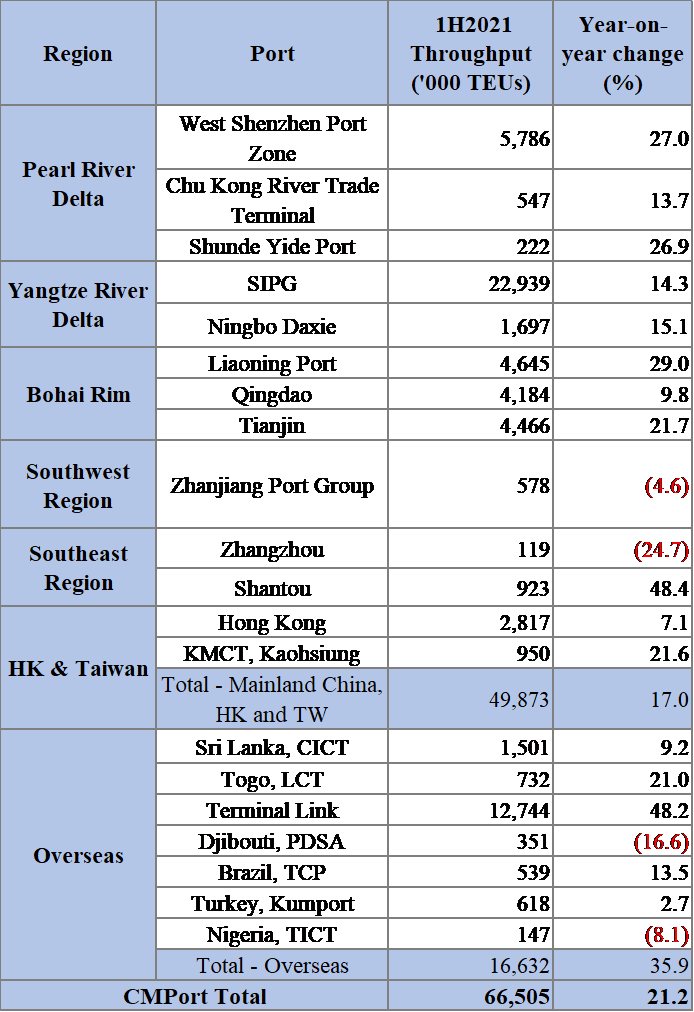

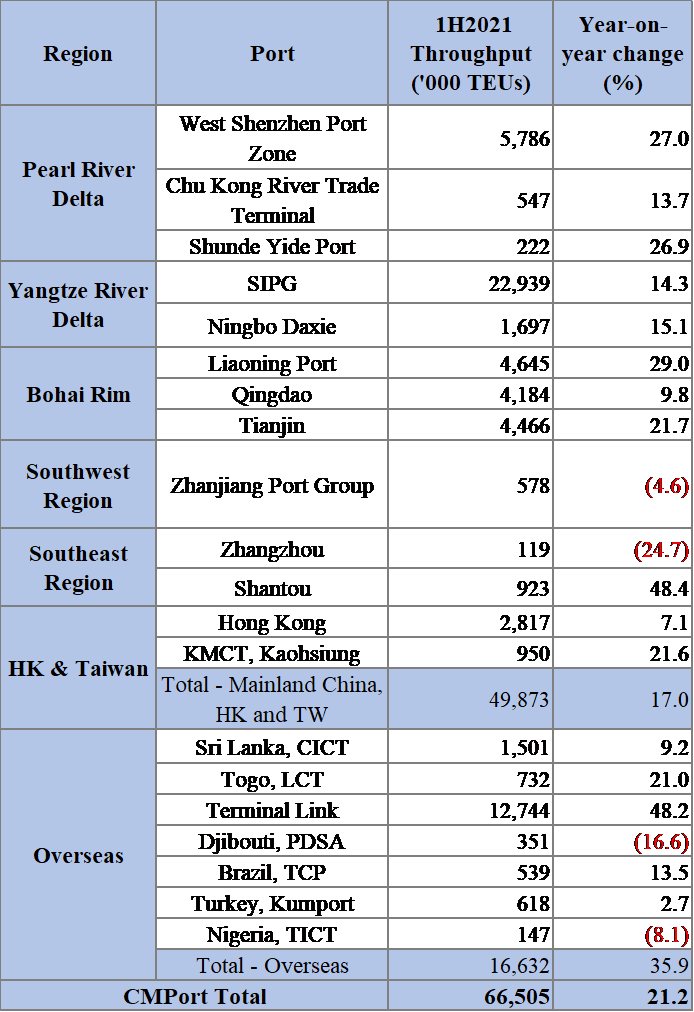

Table:Overview of Container Throughput Volume of CMPort in 1H2021

Container throughput increased by double digits and bulk cargo business reached record high

In the first half of 2021, with the overall positive prospect of the port industry, the overall operation of the Group has recorded a significant increase, which outperformed the overall performance national wide and worldwide. The Group’s ports handled a total container throughput of 66.51 million TEUs, up by 21.2% year-on-year. Among which, the Group’s ports in Mainland China, Hong Kong and Taiwan contributed an aggregate container throughput of 49.87 million TEUs, representing an increase of 17.0% year-on-year, which was mainly benefitted from volume contribution from West Shenzhen Port Zone and Shanghai International Port (Group) Co., Ltd. (“SIPG”), as well as the volume contribution from former Yingkou Port Liability Co., Ltd. (“Yingkou Port”) after its merger into Liaoning Port. The Group’s overseas ports handled a total container throughput of 16.63 million TEUs, representing an increase of 35.9% year-on-year, which was mainly contributed from the additional throughput volume of the eight terminals acquired by Terminal Link SAS since March 2020, as well as the outstanding performance of its terminals located in European countries. At the same time, the consolidated overseas terminals of the Group in Sri Lanka, Brazil and Togo also provide significant contribution.

Bulk cargo volume of the Group reached record high volume with 284 million tonnes handled in the first half of 2021, representing a significant increase of 42.8% year-on-year. Among which, foreign trade volume of feed grain increased significantly in West Shenzhen Port Zone, and , and Yingkou Port contributed significant volume after its merger to Liaoning Port. As for overseas bulk business, Hambantota International Port Group (Private) Limited (“HIPG”) recorded a 338.1% growth year-on-year, its RoRo business and oil and gas business also continues to growth.

Focus on pandemic prevention and business production to ensure the stability of the supply chain

The Group has always highly concerned with pandemic prevention and control, the Group responded actively to the recurring pandemic situation in the first half of the year and secured normal port operations while handling the pandemic prevention and control properly, which reflected the strengths at operation management level. The coronavirus outbreak at Yantian Port in May 2021 has disturbed the stability of the supply chain in South China. CMPort has strengthened the overall planning and coordination of its ports in West Shenzhen Port Zone to ensure normal operation of the ports, while making sure effective epidemic prevention and control has deployed at the same time. Moreover, the Group actively promotes vaccination to its overseas employees and formulates emergency instructions on epidemic prevention to ensure that epidemic prevention and business production are carried out smoothly at the same time. By all means, CMPort has provided a strong support for the smooth transportation channel of domestic and foreign trade.

Speed up the construction of “world-class leading ports” by enhancing the competitiveness of homebase port

The Group adhered to the strategic objective of “building world-class leading ports” by further enhanced the comprehensive competitiveness of the West Shenzhen homebase port. During the first half of 2021, the container throughput of West Shenzhen Port Zone increased by 27% year-on-year, which is higher than the overall Shenzhen ports level with 0.5 percentage increase in its market share. In 28 June 2021, Mawan Smart Port was officially put into operation, which tremendously enhanced the core competitiveness of the West Shenzhen Port Zone, thereby contributing to building “world-class leading ports”. In addition, the Group accelerated the development of the coordinated ports in the Guangdong-Hong Kong-Macao Greater Bay Area and promoted the official launch of the "Shenzhen Shekou-Shunde Beijiao Coordinated Port" project in the first half of the year, which further expanded the coordinated port locations.

For the overseas home port, the Group continuously integrated the operation and management of HIPG and CICT in Sri Lanka, promoted the coordinated development of these two ports as well as the comprehensive development of major projects, thereby comprehensively improving regional competitiveness and influence, and further strengthen the position of Sri Lanka port as a shipping hub in South Asia.

Bonded logistics business has grown steadily

In the first half of 2021, the Group’s bonded logistics business continued to pursue the development direction of diversifying integrated services business, enhanced the utilisation rate of resources at the existing warehouses and yards so as to respond to market changes and the unstable situation under the pandemic.

The average utilisation rate of the warehouses of China Merchants Bonded Logistics Co., Ltd. in Shenzhen was 96%, as a result of active exploration of new clients and business models. China Merchants International Terminal (Qingdao) Co., Ltd. fully utlisiated its resources to develop the self-operated business and the average utilisation rate of the warehouse reached 100%. Tianjin Haitian Bonded Logistics Co., Ltd., which is an associate of the Group, recorded an average utilisation rate of 84% of its warehouses. In Djibouti International Free Trade Zone, the average utilisation rate of the bonded warehouse, which the Group invested in, was 97%, and for the wholly-owned bonded warehouse of the Group, it recorded an average warehouse utilisation rate of 58%.

Mawan Smart Port was officially put into operation and the promotion of “CMCore”

In terms of innovative development, The Group actively promoted the application of “CM ePort” and “CMCore” through the construction project of Mawan Smart Port to promote the digital transformation and intelligent upgrading of ports. The Group’s self-invented “CMCore” has been widely applied to its consolidated terminals and are actively promoting to various domestic and overseas port operators.

Mawan Smart Port was officially put into operation during the first half of the year with a designed annual handling capacity of 3 million TEUs, being a model for upgrade of traditional terminals in both domestic and overseas market. As compared with the traditional ports, Mawan Smart Port has significantly increased its operation efficiency. Its workforce decreased by 80%; comprehensive operational efficiency increased by 30%; potential safety risks reduced by 50%; carbon emissions reduced by 90%, and customs clearance efficiency increased over 30%. Meanwhile, the construction cost of transformation to an automated terminal reduced by 50% compared with a newly-built terminal, achieving considerable economic benefits.

Steady progress on comprehensive development and new breakthroughs on marketing

The Group was committed to improving the global network layout and business synergies in overseas projects, and deepened the implementation of “Port-Park-City” model in overseas regions. In the first half of 2021, under the adverse impact of the continuous spread of the pandemic, the promotion activities of induction of business and investment in overseas logistic parks continued to be steadily progressed, the number of contracted enterprises increased by 49 in the first half of the year to a total number 189, of which HIPG industrial zone and Djibouti International Free Trade Zone reached 27 and 162 contracted enterprises respectively. The comprehensive development has been making sound progress.

Leverage on the substantial improvement of capacity and port conditions from the commencement of operation in new berths at Mawan Smart Port and all-weather navigation of the 200,000-ton waterway channel, the Group strengthened its marketing and business promotion in the West Shenzhen Port Zone. In the first half of 2021, some new shipping routes such as North America line, Asia line and India line were newly added, and further strengthened the Group’s in-depth cooperation with major shipping companies. The Group put more efforts to maintain the existing routes and expand new routes, in order to increase market share in South China.

Ecological green ports development and charity events to reward the society

The Group has committed to the objective of building an enterprise of ecological green ports that strictly abided by relevant environmental protection laws and regulations. The Group also actively responded to the "carbon peak" and "carbon neutral" national strategies, and actively participated in the construction of dual-carbon demonstration projects and carbon verification and compliance. The Group also continued to promote new energy-saving technologies and products such as "Shore-Powered Supply for Vessels (船舶岸基供電) ", "Substitution of Fuel Powered Equipment with Electricity-Powered Equipment (油改電)”, "Engine Upgrade Replacement (發動機升級置換)" and "Belt Conveyor Reformation (皮帶輸送機改造)", as well as "hydrogen" fuel trailers test in order to effectively improve energy efficiency and green shipping development.

The Group adhered to the concept of integration with win-win, giving importance to the mutual support and trust among communities. The Group was committed to giving back to the society through participation in infrastructure construction, talent education, medical assistance and other public welfare projects. In Sri Lanka, the Group donated funds, pandemic prevention supplies and equipment to the communities for their needs to fight for the pandemic. Moreover, CICT and HIPG jointly launched the development of the second "Hope Village" project in Hambantota District, Djibouti project also donated living materials to local poor families. Furthermore, the Group further developed the “Shaping Blue Dreams Together (C-Blue)” charity brand and successfully hosted the meaningful 6 days and 5 nights students development camp named "Growing with Love and Companion of CMPort" (招有愛 伴成長) for 100 teachers and students in Weining County, Guizhou Province.

Grasp the changes in the world pattern and promote high-quality business development

Looking forward into the second half of 2021, global economic and trade will face various challenges, including recurrence of COVID-19 pandemic, unstable political situations, and imbalance of regional recovery. However, as the accelerated vaccination process, the global economy and trade will gradually recover, which is expected to carry out opportunities for the steady growth of port operation in the second half of 2021. Meanwhile, the new digitalisation technology will also be a new driver for the Group to build world-class ports.

In the second half of 2021, China will foster the construction of the new development paradigm featuring dual circulation, in which domestic and overseas markets reinforce each other. With the domestic market as the mainstay, whereby it will accelerate the recovery of domestic demand and continue to provide policy support for the recovery of consumption and investment in manufacturing sector. Overall, the domestic economy is expected to continue the steady recovery. The IMF predicts in its "World Economic Outlook” released in July 2021 that China's economy will grow by 8.1% in 2021, and will remain its leading role in the global economic recovery.

The Group will continue to adhere to the strategic principle of “leveraging on its long-term strategy, tapping the current edges, driving through technology and embracing changes”. In the context of a new development stage, the Group will implement the new development concept, build a new development pattern, and well perform in respect of its digitalisation, marketisation, internationalisation, platformisation and sophistication work, striving to realise its strategic goal of becoming a “world-class comprehensive port service provider” by 2022. Furthermore, the Group will constantly enhance its core capability and profitability to endeavor to maximise shareholders value as always and create value to benefit for all various stakeholders.

Note[1] Profits attributable to equity holders of the Company net of non-recurrent gains after tax. Non-recurrent gains include: for the first half of 2021, change in fair value of financial assets and liabilities at fair value through profit or loss, change in fair value of investment properties, gain on deemed disposal of a subsidiary and gain on deemed disposal of partial interest in an associate; while for the first half of 2020, change in fair value of financial assets and liabilities at fair value through profit or loss, change in fair value of investment properties and net gain on resumption of certain land parcels at Shantou.