CMPort net profit rose 19.8% to HKD6,529 million in 1H 2019

The Board of Directors (the “Board”) of China Merchants Port Holdings Company Limited (“CMPort” or the “Company”, HKSE Code: 00144) is pleased to announce the interim results of the Company and its subsidiaries (the “Group”) for the period ended 30 June 2019.

A press conference was held on 30 August 2019 in Hong Kong and was hosted by Managing Director Dr. Bai Jingtao. Chief Financial Officer Ms. Wen Ling and Head of Finance Department Mr. Sun Ligan also attended the meeting and answered questions from the press.

Bai Jingtao said, “US-China trade frictions created more chances for other countries to cooperate with China, and the Group’s TCP Participações S.A. (“TCP”) in Brazil is one of the beneficiaries. In the first half of the year, despite the box of US routes declined, US routes only accounts for 10% of CMPort's business, hence the overall impact is limited. The total container throughput of CMPort for year 2019 is expected to surpass 100 million TEUs with single digit growth.

Wen Ling said, “CMPort’s participation in Qianhai restructured land indicates the Group’s important position in the construction of urbanization in Shenzhen. The project not only brought HK$3,281million to the Company, but also continuous earnings from Qianhai-Shekou Free Trade Zone commercial development project, through the Group’s 14% stake in a new company.

As for whether the downward trend of CMPort’s bulk cargo business in the first half of the year will be further expanded with intensification of US-China trade frictions, Bai Jingtao said, “The decline in bulk cargo business in the first half will not further deteriorate in the second half. With the arrival of the peak season, it is expected to see a narrower decline in bulk cargo in the second half. At the same time, the rapid growth of Overseas bulk business is expected to continue in the second half of the year, which will partially offset the downward influence from the bulk business in Mainland China.

With regard to the question of whether Hong Kong’s role as international shipping center will be replaced by Shenzhen considering its significant decrease in container throughput in the first half of the year, Bai Jingtao said, “The indicants of an international shipping center are not only container throughput volume it handled, but also support of excellent port facilities, international maritime services and business environment, in which Shenzhen are not able to replace Hong Kong currently. I believed that the Hong Kong Government can handle the current challenges and Hong Kong will keep its status being an international shipping center. ”

Highlights of 2019 interim results of the Group:

l Container throughput volume rose by 1.4% year-on-year to 54.56 million TEUs(1H 2018: 53.81 million TEUs) l Total bulk cargo volume handled 223 million tonnes(1H 2018: 250 million tonnes),down by 10.7% year-on-year l Profit attributable to equity holders of the Company totaled HK$6,529 million(1H 2018: HK$5,448 million),up by 19.8% year-on-year ü Profit attributable to equity holders of the Company from ports operation totaled HK$7,067 million(1H 2018: HK$5,923 million),up by 19.3% year-on-year l Basic earnings per share was 196.07 HK cents(1H 2018:166.22 HK cents),up by 18.0% year-on-year l Interim dividend of 22 HK cents per ordinary share (1H 2018:22 HK cents per ordinary share) |

During the first half of 2019, affected by a number of downside risk such as the deceleration of growth of global economy as well as trade war, the growth of global ports throughput slowed down and the growth of business volume of ports in China also declined during the first half of 2019. Facing the global economic pressure, the Group upheld the strategic principle of “leveraging on its long-term strategy, tapping the current edges, driving through technology and embracing changes”, and focused on the “Project of Improving Quality and Efficiency” as a pivot. By conducting scientific researches on the changes in market conditions, the Group made great efforts in expanding overseas ports network in response to the adjustments of the international industrial landscape. At the same time, the Group accelerated integration and development internally and strengthened synergic cooperation externally, thereby enhancing professional capabilities, improving risk management and control, in return for a steady growth of business. During the first half of 2019, the Group’s ports handled a total container throughput of 54.56 million TEUs, up by 1.4% as compared with the corresponding period last year, and bulk cargo volume of 223 million tonnes, down by 10.7% as compared with the corresponding period last year.

As of 30 June 2019, the Group recorded a revenue of HK$4,464 million, down by 19.7% over the same period last year, which was mainly attributed to the disposal of equity interest in China Merchants Port Group Co., Ltd. (formerly known as “Shenzhen Chiwan Wharf Holdings Limited”or “Shenzhen Chiwan”) last year. Profit attributable to equity holders of the Company amounted to HK$6,529 million, representing an increase of 19.8% over the same period last year, which included a gain of HK$3,281 million (net of tax) recognised from the completion of the Group’s disposal of the restructured land in Qianhai during the period, as well as fair value gain on financial assets, while the amount for the same period last year included a gain from the disposal of equity interest in Shenzhen Chiwan. Profit attributable to equity holders of the Company from ports operation totaled HK$7,067 million,up by 19.3% year-on-year

To appreciate shareholders for their continuous support, the Board of the Company proposed a 2019 interim dividend of 22 HK cents per ordinary share, flat on the same period last year. Shareholders may elect to receive the interim dividend in cash or by way of scrip dividend.

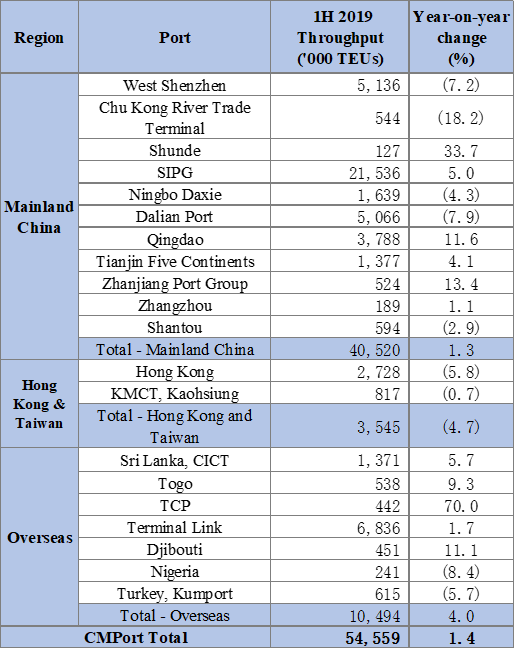

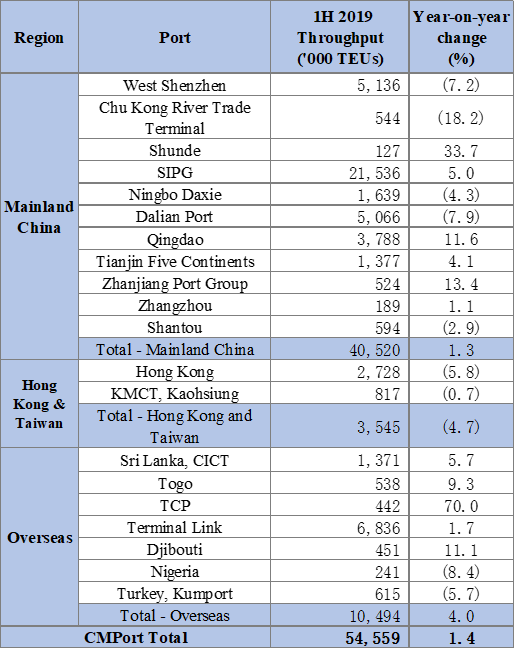

Table:Overview of Container Throughput Volume of CMPort in 1H2019

Overseas and YTD projects boosted the growth of the total container volume

In the first half of 2019, the Group’s ports handled a total container throughput of 54.56 million TEUs, up by 1.4% year-on-year, which was mainly benefitted from the growth in container volume of the Group’s overseas ports and ports in Yangtze River Delta region, China, among which the Group’s ports in Mainland China contributed container throughput of 40.52 million TEUs, indicating an increase of 1.3% year-on-year. The Group’s operations in Hong Kong and Taiwan contributed an aggregate container throughput of 3.55 million TEUs, representing a decrease of 4.7% as compared with the same period last year. A total container throughput handled by the Group’s overseas ports grew by 4.0% year-on-year to 10.49 million TEUs. TCP in Brazil recorded a volume growth of 70.0% year-on-year, which was benefitted from the increase in import and export container volume driven by the growth in the trade of agricultural and meat products. Both greenfield projects, namely Colombo International Container Terminals Limited (“CICT”)in Sri Lanka and Lomé Container Terminal S.A. in Togo, recorded high single-digit growth.

Bulk cargo volume handled by the Group’s ports decreased by 10.7% year-on-year to 223 million tonnes, within which the Group’s bulk cargo business in Mainland China represented a decrease of 11.2% year-on-year, which was mainly affected by the completion of the disposal of Shenzhen Chiwan, strategic adjustments of business structure of Shanghai International Port (Group) Co., Ltd., as well as China’s environmental protection policies. Nevertheless, the Group’s overseas bulk cargo volume outperformed with an increase of 37.4% year-on-year, mainly contributed by the well business progress in Hambantota International Port Group (Private) Limited (“Hambantota Port”), of which bulk cargo business increased significantly from 0.081 million tonnes to 0.455 million tonnes and the wheeled volume increased by 57.6% year-on-year. Moreover, Port de Djibouti S.A. in Djibouti handled a bulk cargo volume of 2.87 million tonnes, up by 23.4% year-on-year, mainly attributed to the increasing import demand for relevant raw materials driven by the small-scale infrastructure projects in Ethiopia.

Strengthen the development of homebase ports to forge the world-class leading port standard

Regarding the development of homebase ports, the Group proactively promoted resources consolidation and accelerated the construction of the world-class leading port. By executing the “Pearl River Delta Strategy”, the Group penetrated into the hinterland of cargos and diverted cargos from the Pearl River Delta to the homebase port. The Group also actively pushed forward the feeder services and customs integration and facilitated the construction of the “PRD NETWORK” platform in a bid to solidify the leading position of our homebase ports among the hubs in Guangdong-Hong Kong-Macao Greater Bay Area. Meanwhile, the Group has stepped up the efforts in the construction of an intelligent port and applied the experiences of innovation projects to a larger scope, including “System of Safety Protection and Operation Support for Container Gantry Cranes” and “RTG Remote Control”, which has improved operational efficiency, reduced operating costs, strengthened trade facilitation and improved the overall competitiveness of the West Shenzhen homebase port.

The Group has further strengthened the construction of CICT, the overseas homebase port, and the cultivation of international talents. Hambantota Port had brought this overall concept into practice, and actively promoted the in-depth cooperation with international business partners. Meanwhile, the business synergy between CICT and Hambantota Port increased continuously with extensive synergic cooperation in aspects of human resources, business expansion, financial management as well as equipment and assets.

Focus on overseas investment with significant achievements in comprehensive development

As for overseas expansion, the Group has identified Southeast Asian and South Asian gateway ports as its key investment targets. Simultaneously, it continued to study investment opportunities for gateway ports in mature market, and strengthened the strategic cooperation with major international shipping companies, and pushed forward port projects and comprehensive development projects adjacent to ports in Africa.

With respect to comprehensive development, the Group actively implemented its comprehensive development model of “Port-Park-City”. In the first half of 2019, a business outsourcing agreement for the oil tank area has been signed for the comprehensive development project of Hambantota port, and the preparation work for the delivery of the maintenance and upgrade of oil tank area was nearly completed. Djibouti International Free Trade Zone was officially put into operation in early 2019. Through active participation and organisation of promotional campaigns, the Group witnessed a positive development in the introduction of business and investment with 66 enterprises registered in the park as of the end of the period.

Innovation cooperation in multiple fields to establish a comprehensive port ecosystem

With regard to innovative development, the Group continued to proactively promote the transformation and upgrade of the Company towards a “comprehensive port service provider”. Regarding the innovative projects, the Group continued to put efforts in establishing the China Ports Venture Capital. Furthermore, on the basis of the application of “E-Port” in West Shenzhen Port Zone, the Group conducted researches and formulated plans for promoting the application of “CM ePort” at all subsidiary level. For digital innovation, the Group has completed the planning for informatisation with the assistance of the professional advisors during the period, aiming to enhance the information management level for the global ports operation of the Group and create new drivers for quality development. Concurrently, Haixing Intelligent Port project has progressed as planned. Block chain electronic invoices has fully applied in West Shenzhen Port Zone, which is the first B2B blockchain electronic invoices system for ports in China. In June 2019, the first “5G intelligent port innovation laboratory” of port industry in Mainland China was unveiled in Shekou, Shenzhen, which marked the commencement of construction for the first 5G intelligent port in Guangdong-Hong Kong-Macao Greater Bay Area.

Promote sustainable development and shape blue dreams together

Aiming at “energy conservation and efficiency enhancement” with “technological innovations” as the means while fulfilling the corporate social responsibility of “conserving energy, reducing emission and carbon footprint, and protecting the environment”, the Group has continued its efforts in promoting the building of low-carbon green port. While continuing to develop new process and technologies, the Group also promoted and extended the application of successful cases such as “Substitution of Fuel-Powered Equipment with Electricity-Powered Equipment (油改电)” and “Shore-Powered Supply for Vessels (船舶岸基供电)” at its ports so as to further expand the application of new energy conservation technologies and products with a view to establishing a new and modern container port zone that is green, efficient, eco-friendly and sustainable with the use of clean energy and green power.

The Group is committed to integrating its corporate core values into the community by actively participating in various community and charitable activities. The Group’s charitable activities adhered to the theme of “Shaping Blue Dreams Together (共铸蓝色梦想)”, which concerns the ocean and humanities. The Group organised the advanced-level training programme for port and shipping management called “Shaping Blue Dreams Together — C Blue Training Programme in the 21st Century (共铸蓝色梦想— 21世纪海上丝绸之路优才计划)”, which adopted an education model that combined theoretical courses with research and investigation, providing training for overseas trainees to acquire professional knowledge and enhance operational capability. 21 trainees from 11 countries across four continents along the Belt and Road completed all training courses and graduated successfully.

Seize the opportunities of industries migration and strive for world-class in multiple aspects

Looking forward to the second half of 2019, affected by factors such as trade frictions, financial markets volatility and increased uncertainties in monetary policies, the stability of global economy will be further undermined, the international container market will be facing more uncertainties. However, the trend of industries migration and the booming emerging markets will bring development opportunities to comprehensive port services overseas. Moreover, the evolution of innovation technology will contribute to the intelligentisation of port and shipping industry, achieving higher efficiency of the industry chain.

In the second half of 2019, the Group will vigorously promote operation and development, aiming to achieve multiple breakthroughs in ports network and innovative transformation through both vertical and horizontal development. Adhering to the vision of “to be a world’s leading comprehensive port service provider”, the Group will capture the opportunities of the market, enhance its core competencies as well as maintain its strategic strength. As always, the Group will endeavour to maximise shareholder value while enhancing profitability, thereby delivering better returns for its shareholders.