CMPort's Performance Shows Steady Growth in First Half of 2023

30.Aug.2023

CMPort's Performance Shows Steady Growth in the First Half of 2023

On August 30, the board of directors of China Merchants Port Holdings Co., Ltd. (hereinafter referred to as "CMPort" or "the Company", Hong Kong Stock Exchange stock code 00144) is pleased to announce the interim results of the Company and its subsidiaries for the period ending June 30, 2023.

2023 Interim Performance Overview:

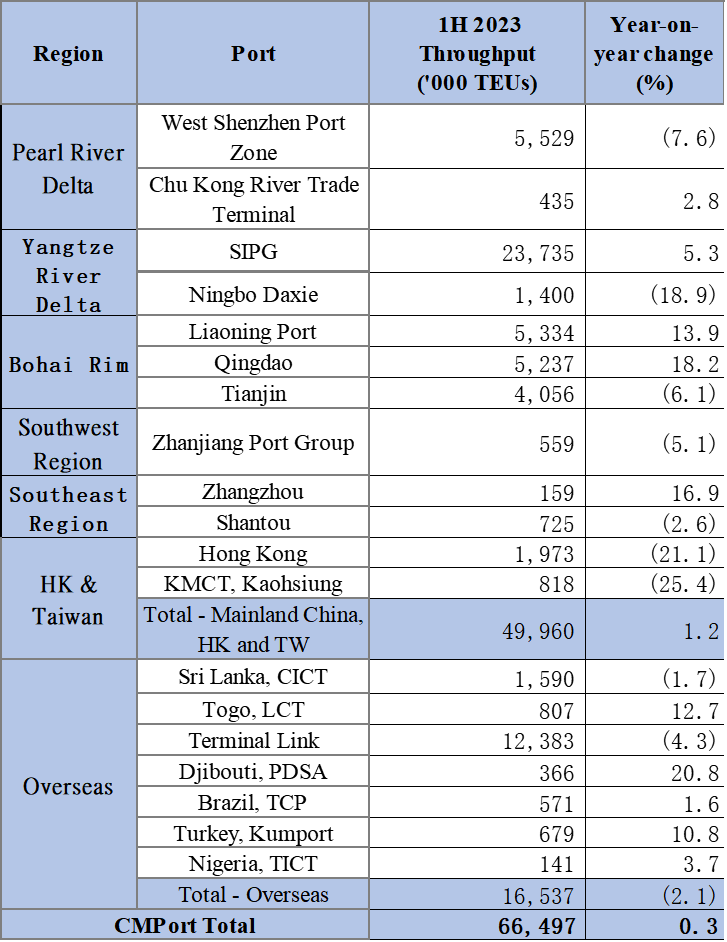

Throughput of containers handled reached 66.50 million TEUs, up 0.3% (2022: 66.28 million TEUs)

Throughput of bulk cargoes handled reached 270 million tons, up 0.2% (2022: 269 million tons)

Revenue of HK$5,805 million (2022: HK$6,508 million), a year-on-year decrease of 10.8%

Recurrent profit attributable to equity holders of the Company [1] was HK$3,325 million (2022: HK$4,974 million), down 33.2% year-on-year

Net Profit attributable to equity holders of the Company amounted to HK$3,351 million (2022: HK$4,825 million), a year-on-year decrease of 30.5 %

Interim dividend of 22 HK cents per ordinary share (2022: 22 HK cents per share)

In the first half of 2023, the Group constantly adhered to the general principle of seeking progress while maintaining stability and persistently focused on “endogenous growth” and “innovation and upgrade”, showing a trend of steady progress with prospects of improvement despite a slowdown in global trade growth. During the first half of 2023, the Company’s ports handled a total container throughput of 66.50 million TEUs, up 0.3% year-on-year; among which, the Group’s ports in Mainland China, Hong Kong and Taiwan saw an increase of 1.2% year-on-year. They handled a bulk cargo throughput of 270 million tons, up 0.2% year-on-year. The Company recorded a total revenue of HK$5,805 million, a recurrent profit attributable to equity holders of HK$3,325 million, and a net profit attributable to equity holders of HK$3,351 million.

In order to reward shareholders for their consistent support, the board of directors of the company proposes to distribute an interim dividend for the year 2023 of 22 Hong Kong cents per ordinary share. Shareholders have the option to receive the dividend in cash or by choosing to have it paid in shares.

Attached table: H1 2023 CMPort Container Throughput Overview

Improving the Comprehensive Competitiveness of the West Shenzhen Homebase Port as a World-Class Port and Strengthening the position of the Overseas Homebase Port in Sri Lanka as the Key Hub in South Asia

In the first half of 2023, the West Shenzhen homebase port and the two homebase ports in Sri Lanka continued to consolidate their regional positions. Despite a decline in overall container throughput in the Guangdong-Hong Kong-Macao Greater Bay Area ("Greater Bay Area"), the Shenzhen homebase port strengthened and further increased its share of foreign trade market within the Bay Area through competitive strategies such as adjusting its business structure. Meanwhile, in a breakthrough, 200,000-ton class vessels were put into night operation in the Tonggu Channel, improving overall operating efficiency.

The Colombo International Container Terminal (CICT) in Sri Lanka actively responded to regional market competition, enhanced its management level and development quality, and maintained its advantageous position in the Colombo port; On this basis, the company promoted the South Asian Commercial and Logistics Hub project steadily, developed the unique competitiveness of its comprehensive services, and created a new development momentum of “port + logistics”. Hambantota International Port Group (HIPG) actively dealt with the impact caused by regional instability; with its strategic positioning and resource advantages, it strengthened market expansion and experienced significant growth in roll-on/roll-off, liquefied petroleum gas, fuel oil, and other transshipment businesses.

Innovating Business Models in Overseas Parks and Promoting Targeted Industries

In pursuit of comprehensive development, the Group was committed to joining hands with overseas parks to carry out professional promotion in areas where industries in which China has a competitive advantage are concentrated. As of the end of June 2023, 48 contracted enterprises moved into the HIPG industrial zone, including park in park, cement plants, duty-free shops, petrochemical and other industries. Furthermore, 332 contracted enterprises moved into the Djibouti International Free Trade Zone, increasing by 45 enterprises as compared with the beginning of the year. Relying on the port and park resources at home and abroad, the company leveraged the advantages of the platform of the “Made by Liaocheng” Djibouti Free Trade Zone exhibition center, opened channels for commodities to and from the ports, and facilitated the upstream and downstream extension of the value chain.

The overall production and operation of the Group's bonded logistics business showed a positive trend. The average warehouse utilization rate of China Merchants Bonded Logistics in Shenzhen reached 98%, that of Qingdao Bonded Logistics was at 100%, and that of Tianjin Haitian Bonded Logistics was at 100%. In the Djibouti International Free Trade Zone, the average utilization rate of the bonded warehouse wholly-owned by the Group was also 100%.

Cultivating the Greater Bay Area and Improving Asset Structure

The company promoted the internal business synergies of the Greater Bay Area, with its coordinated ports business in the Area expanding coverage to all major regions in Guangdong Province. In the first half of 2023, the company set up 5 new locations, reaching a total of 30 locations. The accumulated container throughput was 140,000 TEUs for the first half of the year and a total 400,000 TEUs handled since the coordinated ports began operation, serving nearly 6,000 import and export enterprises.

Regarding capital operation, the company announced in the first half of 2023 the disposal of 45% equity interests in Ningbo Daxie to Ningbo Zhoushan Port Company Limited for RMB1,845 million. This would enable the company to better utilize its existing assets, realize asset value and optimize the regional layout.

Accelerating Scientific Research Breakthroughs, Enhancing Port Comprehensive Service Levels

In terms of innovative development, the company’s comprehensive service platform, namely “CM ePort 3.0”, was officially launched in some ports and terminals and is in sound operation. The Group will continue to expand the scope of online services and continuously improve the comprehensive port service level in the future. The company increased investment in technological research and development, steadily implemented major breakthrough tasks in upgrading the Container Terminal Operating System ("CTOS") architecture, and continuously optimized solutions for mixed-mode autonomous driving technology. Based on the production scenarios of Mawan Smart Port, the Group organized the research and development project on the vehicle-road collaboration, combining autonomous driving and human driving in a bid to conduct normal production while continuously enhancing the efficiency of mixed operation.

Propelling Enterprises and Society towards Sustainable Development

CMPort has been implementing the green and sustainable development rationale by setting “building a world’s leading green and smart port with high quality” as its goal. Firstly, the company strengthened environmental management by carrying out energy conservation and emission reduction measures and addressing climate change in its terminal construction, production, and operation domestically and overseas. Secondly, the company promoted upgrades on digitalization by empowering and facilitating the enhancement of operating capability through technology. Thirdly, the company insisted on performing its social responsibility. During the first half of 2023, the Tenth “C-Blue Training Program” was commenced successfully, which provided a platform for exchange and learning for young talents from the global port industry. The company also vigorously developed the “C-Blue Rural Education” project on the domestic front, while continuing to promote the “C-Blue Hope Village” project in Sri Lanka.

Upholding the Principle of Maintaining Stability and Promoting World-class Construction with High Quality

Looking forward to the second half of 2023, CMPort will persistently uphold the principle of maintaining stability, continuing to make steady progress. Driven by the dual-wheel model of “endogenous growth” and “innovation and upgrade,” with its work centered on the top priority of high-quality development, the company will concentrate on "global layout" and "optimized operation," focus on green, smart, and safety development, promote cost reduction and efficiency enhancement, and spare no effort on implementing every development measure in order to make stable progress on becoming a “world’s leading comprehensive port service provider with high quality.”

[1] Profit attributable to equity holders of the Company net of non-recurrent losses/gains after tax. Non- recurrent losses/gains include: for the first half of 2023, net change in fair value of financial assets at fair value through profit or loss and net change in fair value of investment properties; while for the first half of 2022, net change in fair value of financial assets at fair value through profit or loss, net change in fair value of investment properties and loss on deemed disposal of partial interest in an associate.