CMPort Announced 2017 Annual results Recurrent Profit Rose 19.9% to HKD5,492 million

The Board of Directors (the “Board”) of China Merchants Port Holdings Company Limited (the “Company” or “CMPort”, HKSE Code: 00144) is pleased to announce the annual results of the Company and its subsidiaries (the “Group”) for the year ended 31 December 2017. A press conference was held on 29 March 2018 in Hong Kong and was hosted by Managing Director Dr. Bai Jingtao. Chief Financial Officer Mr. Lu Shengzhou and Deputy General Manager of the Company Mr. Yan Gang also attended the meeting and answered questions from the press.

During the press conference, Dr. Bai Jingtao said,“In 2017,the progress of business expansion in China and overseas of CMPort are satisfactory, andCMPort's ports layout has now completed its coverage in six continents. Looking forward to 2018, we expect the container volume growth of CMPort will stay closely with China's economic growth rate, of which the growth rate of overseas projects will be higher than the projects in Mainland China. The Company will adhere to its principle of maintaining balance between quality, efficiency and scale while expanding its core port businesses, so as to maximise the investment return for our shareholders.”

Regarding the financing needs for the acquisition of Port of Newcastle in Australia, Hambantota port in Sri Lanka and TCP Participaes S.A.(「TCP」)in Brazil, Mr.Lu Shengzhou explained:“According to the projection of 2018,the Company has planned for long-term funding arrangements. We have been tracing the international debt market on an ongoing basis and we will resolve our funding needs with different financing channels to fulfill the needs of our projects under different capital market situation.”

In response to the effect of the China-US trade war to CMPort, Mr.Yan Gang said:“The global economy is on its recovery trajectory, the lost from the trade war can be compensated by the trade from Southeast Asia and Europe. Therefore, we expect a minor effect on the global container throughput. For example, our West Shenzhen homebase port serves relatively small proportion on the US shipping routes, the war might even benefit to CMPort as our business mainly serves Southeast Asia and Europe shipping routes.”

Highlights of 2017 annual results of the Group:

Container throughput handled rose 7.4% year-on-year to 102.90 million TEUs (2016: 95.77 million TEUs); Total bulk cargo volume handled was 507 million tonnes (2016: 460 million tonnes), up 10.3% year-on-year; Profit attributable to equity holders of the Company totaled HK$6,028 million (2016: HK$5,494 million), up 9.7% year-on-year; Recurrent profit attributable to equity holders of the Company amounted to HK$5,492 million (2016: HK$4,581 million), a year-on-year increase of 19.9%; Revenue derived from the core ports operation totaled HK$26,856 million (2016: HK$24,506 million), up 9.6% year-on-year. Ports operation recorded an EBITDA of HK$12,693 million (2016: HK$11,542 million), an increase of 10.0% year-on-year; Basic earnings per share was 183.90 HK cents (2016: 175.58 HK cents), up 4.7% year-on-year; 2017 dividend was 81HK cents per ordinary share (2016: 87 HK cents), implying payout ratio of 43.7%.

|

In 2017, the global economy entered into a relatively strong recovery trajectory with broad-based economic growth, more balanced supply-demand relationship and the trading landscape has ushered in a new round of balance and adjustment. Global ports business generally showed a recovering growth trend. The Group adhered to its strategic directives by building up core competitiveness as a pivot and moving towards the core vision of “to be a world's leading comprehensive port service provider” pursued various designated tasks in a comprehensive and effective manner in order to achieve sustainable growth in its core ports operation and business performance. In 2017, the Group's ports handled a total container throughput of 102.90 million TEUs, grew by 7.4% as compared with last year. Bulk cargo volume handled by the Group's ports was 507 million tonnes, representing an increase of 10.3% as compared with last year.

In 2017, due to the disposal of equity interest in China International Marine Containers (Group) Co., Ltd. (“CIMC”), the Group’s revenueNote1 recorded HK$43,484 million, representing a slight decrease of 1.7% over last year. During the year, revenue from the core ports operation increased by 9.6% over last year to HK$26,856 million, as a result of a rise in business volume. The Group's core ports operation recorded an EBITDANote2 of HK$12,693 million, an increase of 10.0% year-on-year. EBITDA from core ports operation attributed to 82.8% of the Group's total EBITDA.

For the year ended 31 December 2017, profit attributable to equity holders of the Company amounted to HK$6,028 million, up 9.7% over last year, which included the gains on disposal of CIMC and a available-for-sale financial asset of HK$813 million and HK$276 million respectively. Due to an impairment provision of HK$739 million for the investment in an associate with ports operation, profit attributable to equity holders of the Company derived from the core ports operation amounted to HK$ 5,551 million, basically flat with last year. Recurrent profit Note3 attributable to equity holders of the Company was HK$5,492 million, up 19.9% year-on-year.

To appreciate shareholders for their continuous support, the Board of the Company proposed a 2017 final dividend of 59 HK cents per ordinary share, deriving a full year dividend of 81 HK cents per ordinary share which implies a dividend payout ratio of 43.7%. Shareholders may elect to receive the final dividend in cash or by way of scrip dividend.

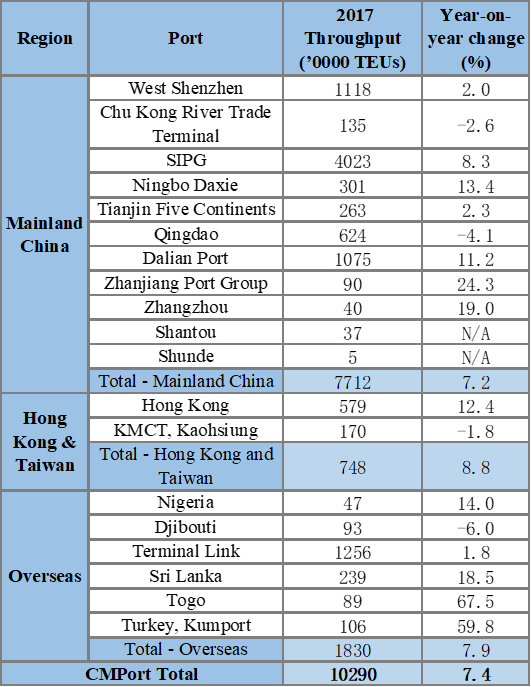

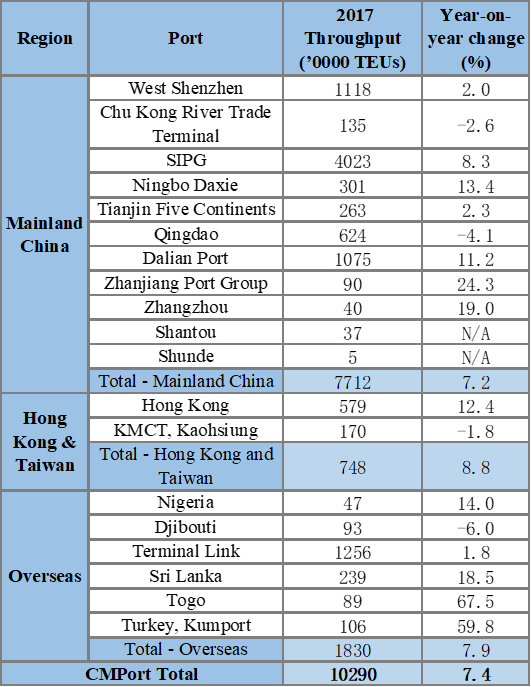

Table: Overview of Container Throughput Volume

of CMPort in 2017

Container throughput surpassed 100 million while overseas greenfield projects shown excellent performances

Benefitted from the contribution from hub terminals along coastal China, as well as from the overseas greenfield projects, the Group's ports operation recorded a historical breakthrough of 100 million TEUs. Looking into the regional performance, container throughput handled by the Group’s ports in Mainland China totaled 77.12 million TEUs, up 7.2%. Ports in Hong Kong and Taiwan handled a combined container throughput of 7.48 million TEUs, up 8.8%, while overseas operations delivered a container throughput of 18.30 million TEUs, up 7.9%. Among which the two greenfield projects Colombo International Container Terminals Limited (“CICT”)in Sri Lanka and Lomé Container Terminal S.A. in Togo outperformed with recorded growth of 18.5% and 67.5% respectively.

Notable results in overseas expansion and steady progress in China's port consolidation

Regarding overseas expansion, in 2017, the Group actively promoted a number of projects in Africa, Latin America and South Asia. On 24 May, the Djibouti project Doraleh Multi-Purpose Port Phase I was put into operation and the work in relation to the transformation of old ports was commenced. On 4 September, a share purchase agreement for the TCP Participações S.A. (“TCP”) in Paranaguá, Brazil was signed, which allows the Group to expanded its presence in Latin America. In December, the Hambantota port project was officially delivered, it will create synergies with CICT project to further promote the construction of the Group's overseas homebase port in Sri Lanka. In 2017, container throughput handled by the Group’s overseas ports contributed 17.8% of its total container throughput, which has become an important driver for the Group's business growth.

With respect to the Chinese port market, based on “regional consolidation and enhancement of synergy”, the Group proactively captured the opportunities arising from consolidation and reform of ports along coastal regions in China. For Bohai Rim, and further deepened the cooperation with Tianjin Port (Group) Co., Ltd. For Yangtze River Delta region, the Group also further strengthened the cooperation with Shanghai International Port (Group) Co., Ltd. and浙江省海港投資運營集團有限公司. For South-East region of Mainland China, the Group became the controlling shareholder of Shantou China Merchants Ports Group Co., Ltd. through capital injection in August 2017, which further promoted resources consolidation for the Group’s ports in South-East region of Mainland China.

Orderly progress in homebase port development while the widening of Tonggu channel is about to complete

With respect to homebase port development, the phase II of Tonggu Channel widening project was expected to be completed in the first half of 2018. The project will create conditions for ultra-large vessels docking at West Shenzhen Port Zone. Renovation project for Haixing Port in West Shenzhen Port Zone has commenced in September 2017, which will build a professional container terminal and promote the construction of smart ports. The above projects, in support of the establishment of “single window”, will proceed with the upgrade and transformation of the Qianhai-Shekou Free Trade Zone with a view to improving the customs clearance environment of the free trade zones on an ongoing basis.

Promotion of “Smart Port”and strengthen the establishment of a comprehensive port ecosystem

With regard to innovative development, the Group formed a special working team in 2017 for innovations to focus on promoting the establishment of a comprehensive port ecosystem on the foundation of ports operation, and enhanced the synergy and cooperation between the relevant involved parties in port business. Key projects included smart ports construction, which integrated port-related businesses such as customs, port and trade via “E-Port” unified customer service platform. It launched the global intelligent container project and built container cargo situation analysis platform based on big data. Commence deep cooperation in the fields of port big data and intelligent hardware and software by focusing on the direction of “Smart Port”.

Adhere to sustainable development and shaping blue dreams together

Aiming at “energy conservation and efficiency enhancement” with “technological innovations” as the means while fulfilling the corporate social responsibility of “conserving energy, reducing emission and carbon footprint, and protecting the environment”, the Group has continued its efforts in promoting the building of low-carbon green port. Further expand the application of new energy conservation technologies and products with a view to establishing a new and modern container port zone that is green, efficient, eco-friendly and sustainable with the use of clean energy and green power.

The Group is committed to integrating its corporate core values into the community by participating actively in various community and charitable activities. The Group organised the advanced-level port and shipping training programme namely “Shaping Blue Dreams Together - C Blue Training Programme (共鑄藍色夢想 — 21世纪海上絲綢之路優才計劃)”for 28 participants from 13 countries along the “Belt and Road”route。The Group also donated cash to the Kashgar Prefecture of Xinjiang for the support of construction of a comprehensive bonded zone in Kashgar; donated emergency supplies and cash to flooded areas in Sri Lanka and emergency aid of batches of food; donated cash to earthquake-stricken areas in Hambantota, Sri Lanka to support local home reconstruction and fisheries recovery after disaster. It also continued to run the “Shaping Blue Dreams Together — C Blue Restore Sight Project (共鑄藍色夢想 — 招商局一帶一路光明行)”, providing free surgeries for patients who were poor and suffered from eye diseases in Hambantota, Sri Lanka and the surrounding areas.

Adhere to the balanced development and make progress while maintaining stability

Looking into 2018, it is expected that the strong growth in 2017 will continue. The favorable global financial environment and the strong market sentiment will help to maintain the rapid growth of demand, especially the demand in investment, which will have a significant impact on the growth of economies with large export volume. China's economy is expected to sustain a steady pace of growth. The forecast published by the IMF suggested that the Chinese economy will grow by 6.6% in 2018, demand in the shipping industry has picked up, the tax reduction policy of the United States will boost the export demand for co-loading with reasonable shrink of the supply side of dry bulk shipping, as such, the industry will continue to improve and the port industry will benefit from the overall recovery of shipping industry.

In 2018,CMPort has performed a grand opening on its business development in the overseas. In February,CMPort completes its acquisition on Brazil's TCP project. On 19 March, the Company was duly approved by its minority shareholders to acquire the 50% interest of Port of Newcastle in Australia which is the World's largest thermal coal export port. Upon completion, the Group’s ports layout will achieve its coverage in six continents.

In 2018, the Group will focus its work on “enhancing core capability, insisting on both quality and efficiency, capitalizing on opportunities of this era and striving to become a world’s leading enterprise” as the main direction. Under the new strategy of comprehensive port development, the Group will strive to upgrade itself from a terminal operator to a comprehensive port services provider. It will step up its efforts in steadily promoting the “Port-Park-City” model with a view to optimising the organisational structure and building up its capacity to stay in line with the new business model. CMPort will navigate its business operations and adjust operational strategies by following the strategic guidance. As always, the Group will endeavour to maximise shareholder value while enhancing profitability, thereby delivering better returns for its shareholders.

Note1: Include revenue of the Company and its subsidiaries, and its share of revenue of associates and joint ventures.

Note2: Earnings before net interest expenses, taxation, depreciation and amortisation but excluding unallocated income less expenses and profit attributable to non-controlling interests (“Defined Earnings”) of the Company, its subsidiaries and its share of Defined Earnings of associates and joint ventures.

Note 3: Profit attributable to equity holders of the Company net of non-recurrent gains after tax. Non-recurrent gains include: for 2017, gain on disposal of a subsidiary, gain on disposal of an available-for-sale financial asset, gain on deemed disposal of interests in associates, impairment loss of interest in an associate and change in fair value of investment properties; while for 2016, gain on disposal of an available-for-sale financial asset, gain on deemed disposal of interests in associates and change in fair value of investment properties.